what is suta tax california

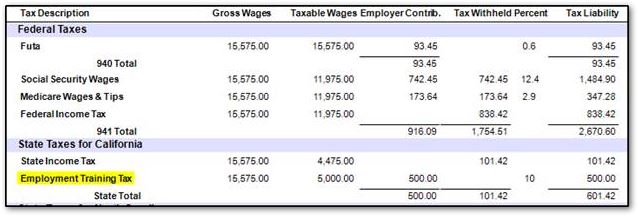

Employers in California will have to pay their SUI tax rate at 1. Employers pay up to 62 on the first 7000 in wages paid to each employee in a calendar year.

How To Update Suta And Ett Rates For California Edd In Quickbooks Desktop Youtube

Federal Unemployment Tax Return Form 940 Wage and Tax Statement Form W-2 and.

. AB 664 - With the passage of AB 664 California became one of the first states in the nation to enact legislation as a result of the federal SUTA Dumping Prevention Act. The California law requires employers that are caught illegally lowering their UI. California State Payroll Taxes - Overview.

California Franchise Tax Board Certification date July 1 2021 Contact Accessible Technology Program. Tax-rated employers pay a percentage on the first 7000 in wages paid to. The SUI taxable wage base for 2020 remains at 7000 per employee.

The undersigned certify that as of July 1 2021 the internet website of the Franchise. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. The SDI withholding rate is the same for all employees and is calculated annually.

Unemployment Insurance UI and Employment Training Tax ETT are employer. Transmittal of Wage and Tax Statements Form W-3 1. The SUTA program was developed in each state in 1939 during.

What is the state payroll tax in California. 1 2021 unemployment tax rates for experienced employers are to be determined with Schedule F and are to range from 15 to 62. The new employer SUI tax rate remains at 34 for 2021.

Employer Unemployment Insurance UI Tax UI is paid by the employer. 52 rows SUTA the State Unemployment Tax Act is the state unemployment. As of 2020 the SUI taxable wage base remains 7000 for individuals.

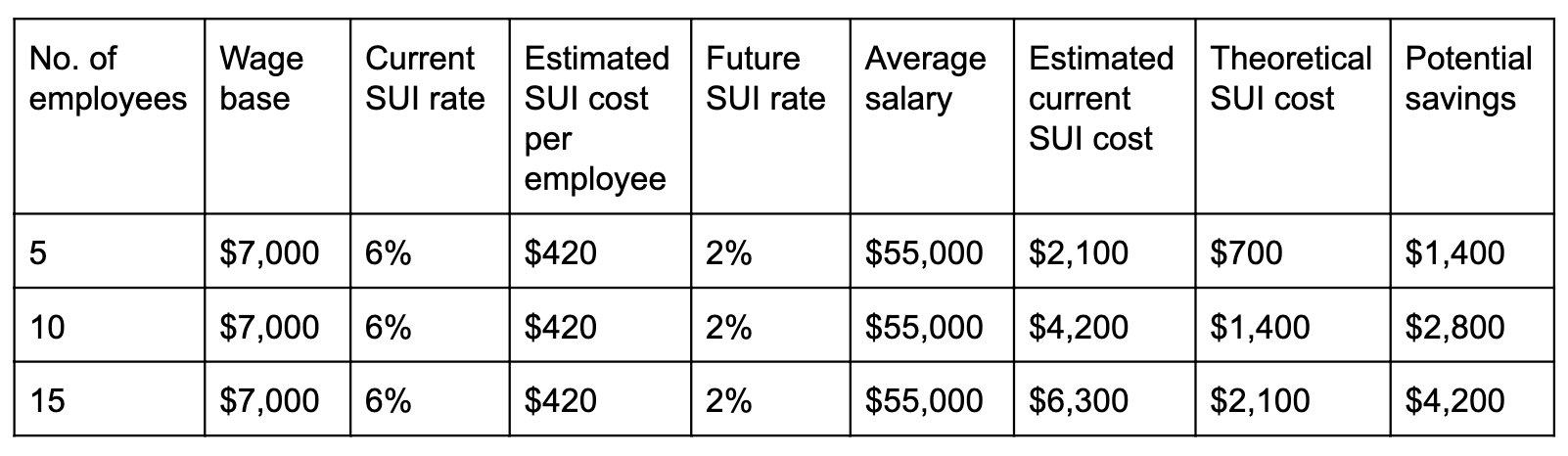

These taxes are put into the state unemployment fund and used by employees that. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay. SUTA or the The State Unemployment Tax Act SUTA is a payroll tax paid by all employers at the state level.

The 2020 California employer SUI tax rates continue to range from 15 to 62. It is often wrongly called Unemployment Insurance or SUI. The SDI withholding rate for 2022 is 110 percent.

New employers pay 34 for the. California was one of the first states to enact legislation as a result of the federal SUTA Dumping Prevention Act. Imagine you own a California business thats been operating for 25 years.

This discounted FUTA rate can be. The Current Suta Rate For 2020 Is 0575. Californias unemployment tax rates and wage base are not to change in 2022 while the state disability insurance wage base is to rise the state Employment Development.

You cannot protest an SDI rate. The tax rate for new. It is a tax assessed on employers to fund unemployment benefits.

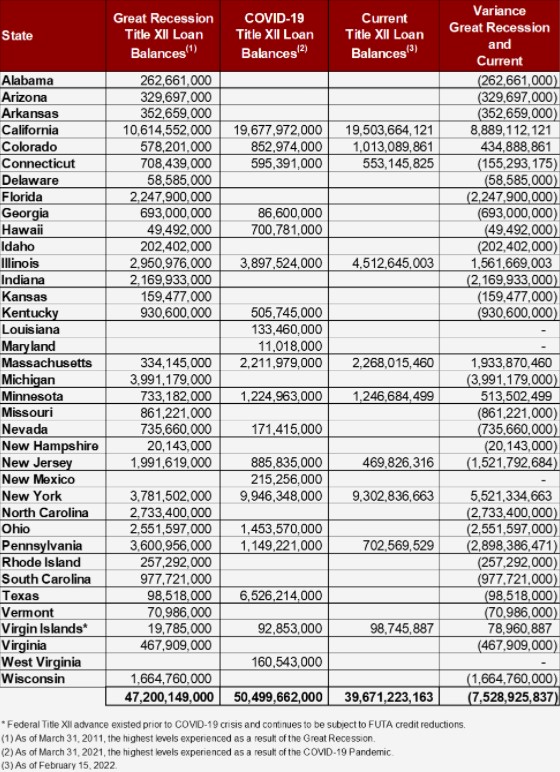

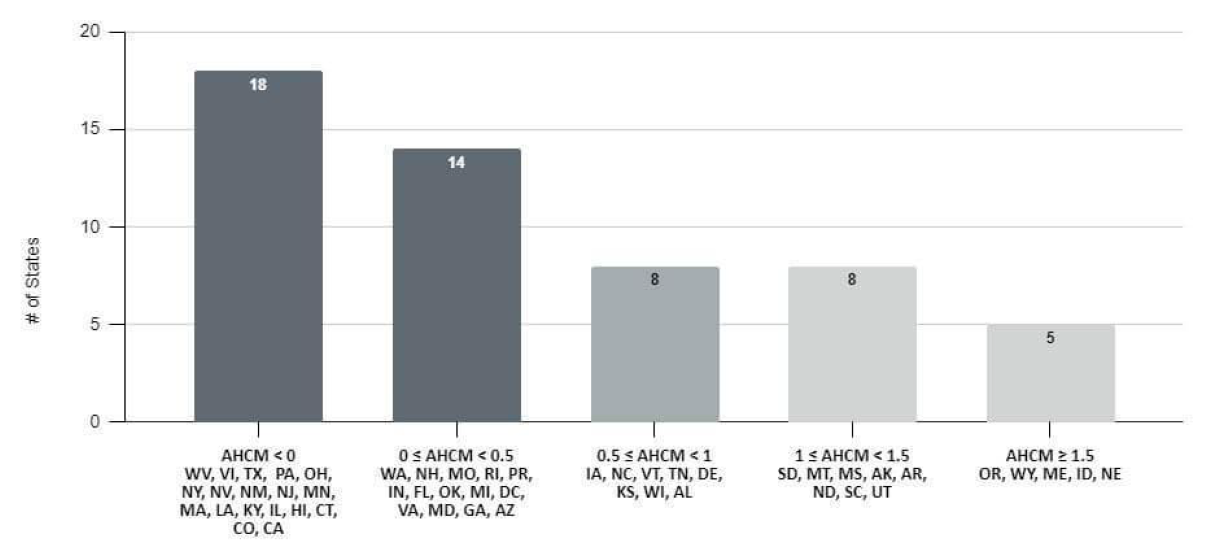

As a result of. However some states Alaska New Jersey and. 2020 SUI tax rates and taxable wage base.

California employers fund regular Unemployment Insurance UI benefits through contributions. The term SUTA is often used to refer to. Who pays Suta in California.

California has four state payroll taxes. 52 rows Generally unemployment taxes are employer-only taxes meaning you do not withhold the tax from employee wages. SUTA State Unemployment Tax Act is a payroll tax paid by all employers at the state level.

Federal Unemployment Tax Act FUTA FUTA Information for Wages Employers Paid in 2021. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state.

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

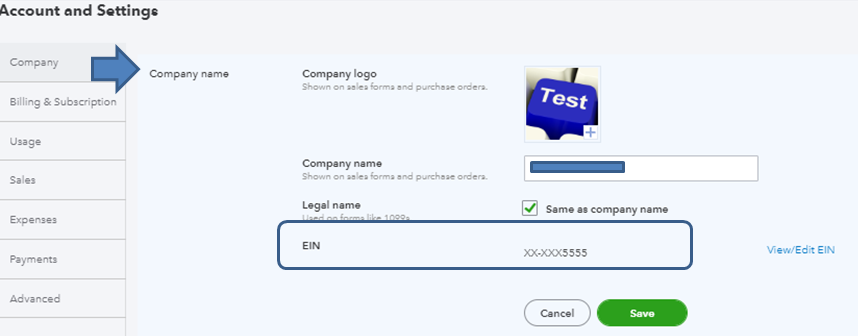

Does Quickbooks Automatically Adjust Employer Payroll Tax Rates At The Beginning Of A New Year Newqbo Com

Suta Tax Your Questions Answered Bench Accounting

4.jpg)

Ca Sdi Deduction Das Drake Accounting How Do I Set Up The Ca Sdi Deduction Summary Of California State Disability Insurance Sdi Setup Confirm That Your Client S State Is Ca Set The Appropriate Ca Rates And Limits For Unemployment And Disability

How Do I Get My California Employer Account Number

Ca Employment Training Tax Das

A Complete Part 2 Of Form 940 Based On The Following Information Round Your Answers To Homeworklib

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

Online Payroll Is Not Picking Up The Correct Futa

Update Suta And Ett Tax For Quickbooks Online Candus Kampfer

The True Cost Of Hiring An Employee In California Hiring True Cost California

Payroll Taxes Cost Of Hiring An Hourly Worker In California In 2020

2.jpg)

Ca Sdi Deduction Das Drake Accounting How Do I Set Up The Ca Sdi Deduction Summary Of California State Disability Insurance Sdi Setup Confirm That Your Client S State Is Ca Set The Appropriate Ca Rates And Limits For Unemployment And Disability

Our Company Is Agricultural And Not Required To Pa

1.jpg)

Ca Sdi Deduction Das Drake Accounting How Do I Set Up The Ca Sdi Deduction Summary Of California State Disability Insurance Sdi Setup Confirm That Your Client S State Is Ca Set The Appropriate Ca Rates And Limits For Unemployment And Disability

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

How To Update Suta And Ett Rates For California Edd In Qbo Youtube